Who We Are

Arcus is an independent infrastructure fund manager focused on digital, transport, logistics & industrials, and energy, exclusively in the European market.

Our deep industry expertise, skilled and cohesive team and extensive European network position us well to identify businesses with long-term value creation potential and which deliver sustainable and profitable growth throughout the investment cycle.

Creating Value

Arcus has a proven and repeatable approach to value creation based on its people, structure and process. We drive results by implementing the Arcus Asset Management Framework to actively create value in four key areas:

Shareholder

Leadership

Management

Excellence

Strategy

& Operations

Finance

& Reporting

OUR STRATEGY

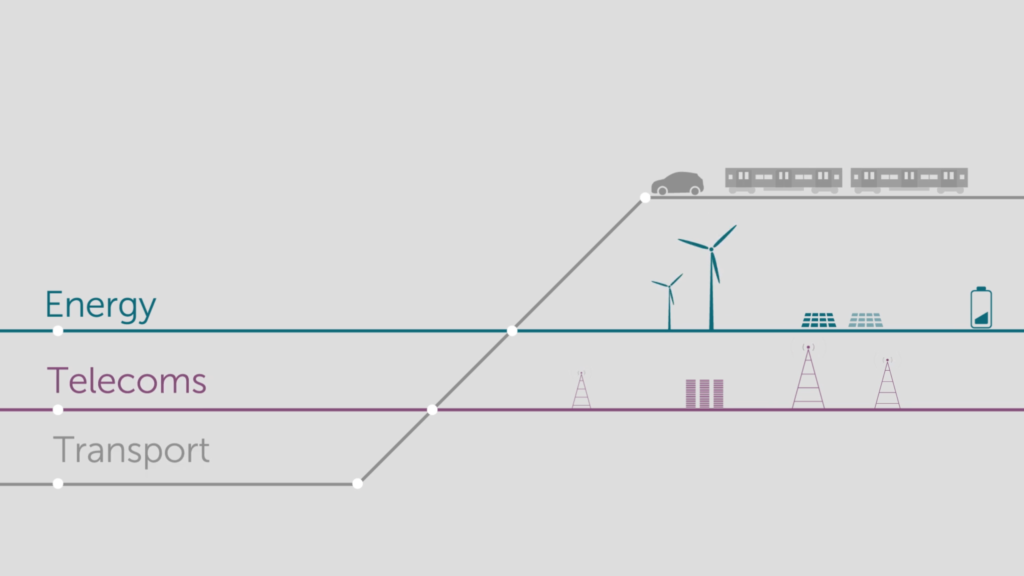

European infrastructure requires €7tn in new investment by 2030. Arcus has identified three primary long-term trends influencing the sector from today: the shift towards a low carbon economy, changing demographics and increasing reliance on data.

The European Infrastructure Landscape

Portfolio

Arcus has invested over €8.1bn of equity capital in 20 European infrastructure businesses (15 current, five realised) since inception.

Transport

Continental Europe’s largest and most diversified specialist rolling stock lessor

Transport

One of the world's largest motorway operators and Portugal's largest transport infrastructure company

Logistics & Industrials

Platform comprising market-leading cold storage and logistics businesses across Europe

Logistics & Industrials

Leading European pureplay rental specialist of industrial temperature control equipment

Transport

Concessionaire of the AmberOne A1 152km dual-lane motorway linking Gdansk with Torun, in Poland

Logistics & Industrials

Leading provider of rental, washing and integrated logistics services for returnable transport items (RTIs)

Energy

A growing and dynamic Meter Asset Provider working to develop sustainable partnerships with energy providers in the UK

Energy

A European clean energy investment and services platform covering the full lifecycle and value chain

Energy

Leading submetering provider for the housing industry in Germany

Transport

Premium market leading vehicle inspection operator in Sweden

Transport

Fast-growing ISO tank container lessor of green and sustainable intermodal assets

Digital

A growing datacentre group focused on serving regional edge markets in Germany and surrounding countries

Energy

Fifth largest meter asset provider in the UK with a large and growing portfolio of smart meters

Digital

A fibre-to-the-home (“FTTH”) business that develops, builds and operates FTTH networks in rural and medium dense areas of Switzerland.

Digital

Leading telecommunications infrastructure company with a strong position in a crucial part of the value chain for TV broadcast, radio broadcast and mobile telecoms.

Team

We are a team of 35 investment professionals with 21 nationalities and on average 12 years of infrastructure experience. The core investment team has worked together for around 14 years.

There is a breadth of knowledge across the team in all key infrastructure sectors and investment life cycle, as well as in-house specialist expertise in finance, debt, treasury, legal and tax structuring.