Amstelveen / Amsterdam / Boston / London, 8 March 2021

APG has agreed to transfer Fund interests representing a 12% indirect interest in Alpha Trains, the leading passenger train and locomotive leasing company in continental Europe, to HarbourVest, Pensioenfonds PGB and a third undisclosed investor

Following APG’s earlier announcements of its acquisitions of Alpha Trains’ direct and indirect equity interests, the largest Dutch pension manager announces the completion of its acquisition of a 20.9% direct interest in Alpha Trains from AMP Capital Investors. Simultaneously, APG also completed a secondary transfer of limited partnership interests in Arcus European Trains SCSp (“AET” or the “Fund”, and owner of a 51.1% interest in Alpha Trains) equivalent to a 12% indirect interest in Alpha Trains to a group of institutional investors comprising HarbourVest, Pensioenfonds PGB and a third undisclosed investor. Arcus continues in its role as manager of AET on behalf of APG, HarbourVest, PGB and the undisclosed investor.

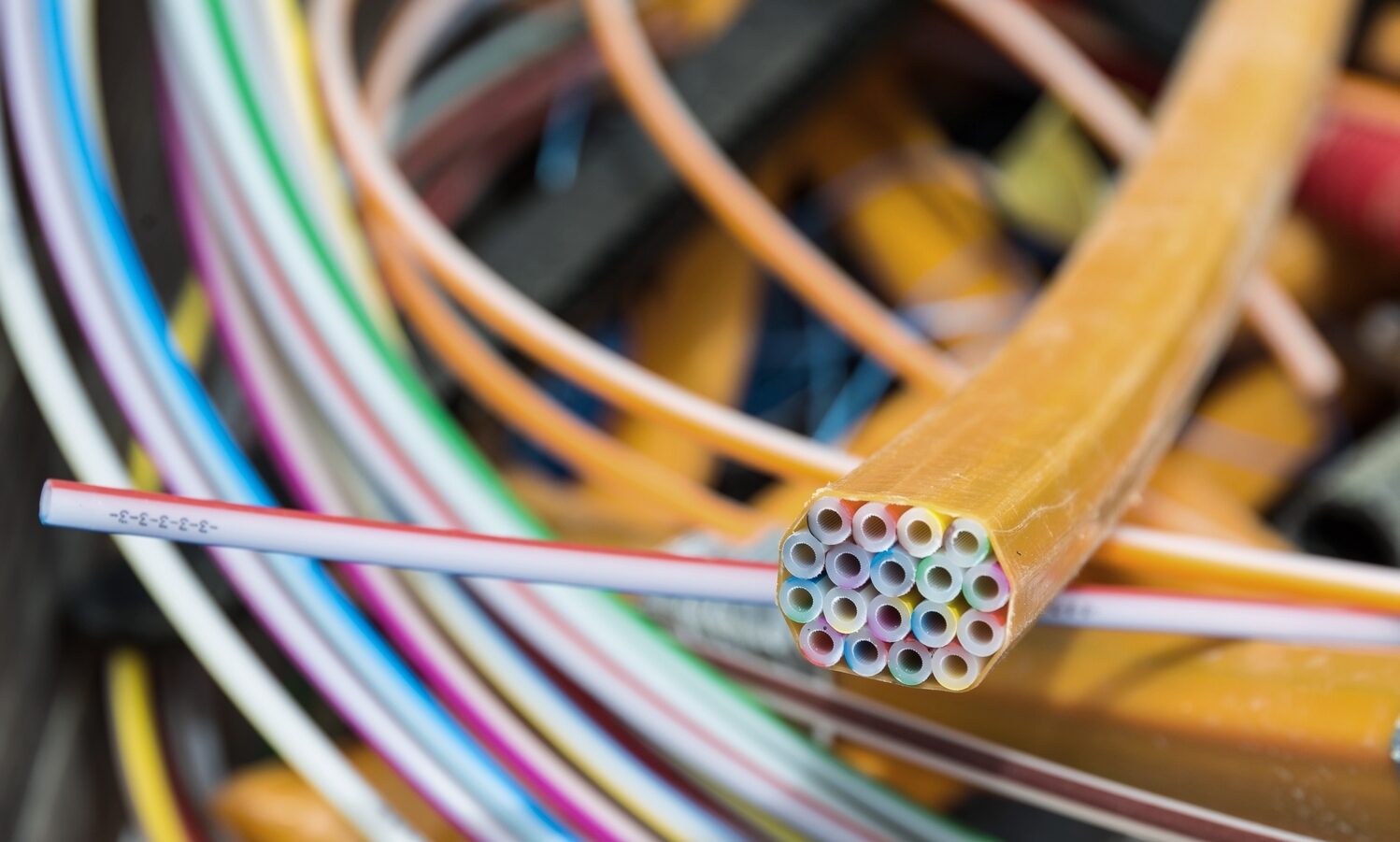

Alpha Trains provides rolling stock to train and locomotive operators under operating and finance leases, which provides train operators with the flexibility to respond dynamically and commercially to opportunities presented in the rail transport market. The Alpha Trains portfolio consists of more than 850 passenger trains and locomotives – including assets in procurement – on lease across continental Europe, including Germany, Benelux, France, Italy, and Spain, and is the market leader amongst the privately-owned rolling stock lessors. The majority of its fleet is electric, making a significant contribution to the decarbonization of Europe’s transport sector.

Carlo Maddalena, Senior Portfolio Manager, APG, said: “We have strong conviction that Alpha Trains will continue to expand its business and consolidate its leadership in Europe’s rolling stock sector. We look forward to continuing to work with Arcus to develop and grow the Alpha Trains business and welcome HarbourVest and PGB investment via the Fund as partners who share Arcus and our strategy and vision for Alpha Trains.”

Kevin Warn-Schindel, Managing Director, HarbourVest Partners commented: “Alpha Trains is a market leader in a growing industry that provides essential European rail infrastructure. We were able to leverage our secondaries infrastructure platform and access our strategic relationship network to source this deal. We are excited by the opportunity to partner with Arcus on this endeavor, providing investors in our core infrastructure strategy exposure to this scalable company.”

Yorick Groen, Senior Portfolio Manager, PGB said: “Sustainable businesses are at the center of PGB’s investment strategy and Alpha Trains provides an ideal investment for PGB into infrastructure in Europe. With this investment PGB contributes to the upgrade and decarbonization of the European transport ecosystem and facilitate modal shift of people and goods from road and air, onto the railway network.”

Neil Krawitz, Partner, Arcus stated: “Over a 12-year period Arcus has worked in close partnership with Alpha Trains’ executive management team to develop the business, cementing its position as continental Europe’s leading rolling stock provider. We look forward, with the support of the high-quality long-term investors in AET, to the next chapter in the growth of the Alpha Trains business – its fundamentals as a critical infrastructure business in a growing and liberalizing industry providing sustainable transport assets is just as attractive today as it was in 2008.”

Media enquiries

APG

Dick Kors/ +31 6 3402 0751

_ _ _

Arcus

Debbie Johnston / +44 7532 183 811

Callum Spreng/ +44 7803 970 103

_ _ _

HarbourVest

Andrew Hopkins, Corporate Communications Manager / +1 617 348 8372

ahopkins@harbourvest.com

_ _ _

Pensioenfonds PGB

Ans Bouwmans/ +31 (0) 6 31 666 986

a.bouwmans@pensioenfondspgb.nl

_ _ _

Alpha Trains

Heike Zimmermann/ +49 221 9140 9063