Insights.

Updates.

News.

Providing up-to-date coverage of Arcus and our portfolio companies

- Arcus

- Our News

London, 18 October 2024

This summer, we hosted our second social mobility targeted internship for four university students who are alumni members of The Sutton Trust. One of our interns, Murray, tells us about his experience.

Why did an internship at Arcus appeal to you?

I was initially drawn to the summer internship at Arcus due to their focus on investment in renewable energy and infrastructure. With my background in renewable energy and a keen interest in the tangible impacts of infrastructure, this internship seemed like an ideal opportunity for professional development. The chance to learn about diligent financial analysis and explore significant investment opportunities was something I couldn’t miss out on!

How have you found your experience at Arcus?

My time at Arcus has been thoroughly rewarding. Immersing myself in the private equity industry and the energy infrastructure sector has significantly improved both my technical and soft skills. This growth has been fuelled by the continual support and extensive knowledge shared by all the professionals at Arcus, for which I am extremely grateful.

What responsibilities did you have during your internship?

During my six-week internship, I gained valuable exposure to Arcus’ investment process. I engaged in the origination processes, critically analysed prospective investments, and considered market conditions and Arcus’ investment criteria. I honed my technical skills by analysing financial statements, formatting PowerPoints, and Excel documents, and creating databases to assess the suitability of our debt advisors and lenders for future investments.

What was the most significant thing you learned/experience you had during your internship?

The most significant thing I learned at Arcus was how to conduct accurate valuations and perform financial forecasts. This exercise, while quantitative, required a strong understanding of market conditions, company performance, and the macro-economy. Developing analytical thinking in this aspect will greatly benefit me in the future, and I am grateful for the excellent guidance and support I received.

What did you find interesting about the Arcus sector team that you were involved with?

Within the energy team, I looked at an asset called a ‘Synchronous Condenser’ and found it particularly interesting. This asset stabilises the frequency along the national grid, requiring a unique investment perspective influenced by regulation and global affairs. Learning about the technology behind these investments piqued my intellectual curiosity, making the internship a valuable educational experience in both finance and technology.

Are there any other growth areas you’re interested in?

I am particularly interested in the growing industry of smart meters. Arcus’ investments in smart meters, aimed at tackling climate change through improved energy efficiency, fascinate me. I am eager to see how this industry evolves with increasing urbanisation and AI innovations, which will make smart meters more intelligent and efficient.

What are you looking to do next?

After this internship, I am confident in my desire to pursue a career in the financial industry, especially within private equity. Analysing companies from an asset management perspective and actively adding value was one of the most enjoyable parts of the internship. The experience at Arcus has been extremely beneficial for my personal and professional development, and I am profoundly thankful for the continual support and guidance from everyone at Arcus.

- Arcus

- Our News

London, 08 October 2024 – Arcus Infrastructure Partners (“Arcus”) is delighted to announce the appointment of Ronak Patel as Partner and Head of Capital Formation & Investor Relations.

Ronak joins Arcus from Campbell Lutyens, where he was a Partner in the firm’s infrastructure and energy transition practice and where his responsibilities included investor distribution, mandate origination, and fundraising execution. Ronak brings with him over 18 years of fundraising, investor communications, and GP advisory experience. He has worked on over 35 fundraising mandates, representing c. €30 billion of aggregate investor commitments.

Ian Harding, Managing Partner at Arcus, comments: “We are very pleased to welcome Ronak to Arcus. He joins at an exciting time for our business following the closing of AEIF3 earlier this year. We continue to believe that strong, long-term relationships with our investors are key to the continued success of Arcus. With Ronak’s appointment, and the wider growth of our investor relations team over the last year, we believe that Arcus is well-placed to offer not only outstanding investment returns but also a best-in-class investor service to our underlying limited partners.

Ronak Patel, Partner and Head of Capital Formation & Investor Relations at Arcus, adds: “I am delighted to be joining Arcus. I have known and admired the team for many years whilst at Campbell Lutyens, with the team having demonstrated a truly differentiated investment approach within the European mid-market infrastructure space. I am thrilled to have an opportunity to contribute to the firm’s journey over the years to come.”

About Arcus

Arcus Infrastructure Partners is an independent fund manager focused solely on long-term investments in European infrastructure. Arcus invests on behalf of institutional investors through discretionary funds and specialist co-investment vehicles and, through its subsidiaries, currently manages investments with an aggregate enterprise value of c. €24n (as of 30 June 2024). Arcus targets mid-market, value-add infrastructure investments, with a particular focus on businesses in the digital, transport, logistics & industrials, and energy sectors. Further information on Arcus Infrastructure Partners can be found on .www.arcusip.com.

- Digital

- Our News

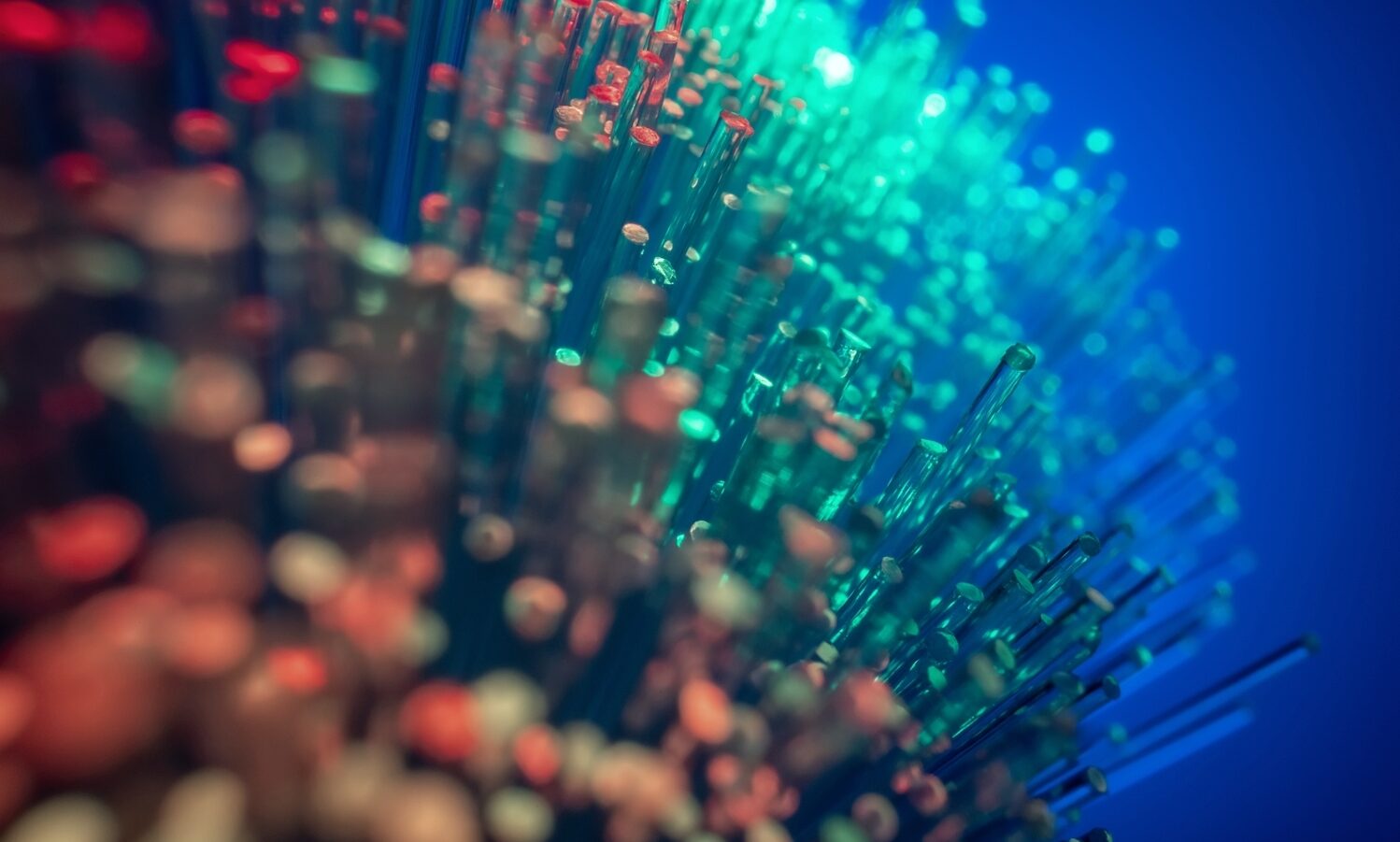

London | Warsaw, 17 September 2024 – Arcus Infrastructure Partners (“Arcus”) is pleased to announce the acquisition of FixMap sp. z o.o., (“FixMap”), a Polish fibre-to-the-home (“FTTH”) business. Arcus European Infrastructure Fund 3 SCSp (“AEIF3”) has acquired a majority interest in the business, with the founder, Piotr Muszynski, retaining a minority shareholding and continuing as CEO.

This is the sixth acquisition for Arcus’ third fund, AEIF3, and Arcus’ third direct FTTH investment following its investments in Swiss4net and E-Fiber through its second fund, Arcus European Infrastructure Fund 2 SCSp. Founded in 2018, FixMap has grown through an ongoing buy-and-build strategy and now operates through 20 local subsidiaries, covering c. 270k homes passed with c. 100k homes connected across Poland. FixMap subsidiaries are both network operators as well as active retail and wholesale internet service providers.

FixMap’s networks are primarily located in semi-rural areas of Poland, where population and housing density is relatively low and there are limited high-speed broadband alternatives. These areas have been the main beneficiaries of the Polish government’s subsidy programmes to support the funding of greenfield fibre deployment.

Arcus plans to create significant value through asset management, particularly in relation to the Company’s existing operations and supporting continued growth under a buy-and-build strategy.

Christopher Ehrke, Partner and Head of Digital at Arcus, commented: “We have been assessing the Polish fibre market since early 2022. During this time, we have explored several opportunities and gained a strong understanding of the market. We identified FixMap as a great investment for AEIF3 thanks to its experienced and professional management team, strong track record of M&A, and its positioning as a regional leader in an underserved and growing market. We look forward to working with Piotr and the team at FixMap to execute on its next phase of growth.”

Piotr Muszynski, Founder and CEO at FixMap, added: “I am delighted that Arcus is now a long-term partner, supporting FixMap on the next phase of our growth strategy in the Polish FTTH ISP market. The Arcus team brings experience in both the FTTH market generally, and strategic growth and consolidation through M&A. We very much look forward to working with the Arcus team.”

Arcus was advised by Rymarz Zdort Maruta (Legal), Trigon (M&A), PwC (Financial, Tax and Structuring), Kearney (Technical and Commercial), Arcadis (IT) and Aon (Insurance).

FixMap was advised by Santander Bank (M&A), WKB (Legal), EY (Financial & Tax VDD), Innside Tax (Tax Structuring).

About Arcus

Arcus Infrastructure Partners is an independent fund manager focused solely on long-term investments in European infrastructure. Arcus invests on behalf of institutional investors through discretionary funds and specialist co-investment vehicles and, through its subsidiaries, currently manages investments with an aggregate enterprise value of c. €23bn (as of 31 March 2024). Arcus targets mid-market, value-add infrastructure investments, with a particular focus on businesses in the digital, transport, logistics & industrials, and energy sectors. Further information on Arcus Infrastructure Partners can be found on www.arcusip.com.

About FixMap

FixMap was founded in 2018 by Piotr Muszyński, a manager with experience in both the telecommunications industry and business consulting. FixMap operates a buy-and-build strategy through M&A activity, with the objective of consolidating the fragmented Polish FTTH market. FIxMap currently operates through 20 local subsidiaries, covering c. 270k homes passed with c. 100k homes connected across Poland (as of August 2024).

- Logistics & Industrials

- Our News

London, 5 August 2024 – Coolworld Rentals (“Coolworld”), a European specialist in industrial temperature control asset rental solutions, has acquired The CRS Group (“CRS”), a leading provider of modular cold storage solutions in Ireland and the UK. Coolworld is partnering with the founding family behind the CRS business, including brothers John and Patrick Tyrrell, who will become shareholders in the wider, pan-European group and who will continue in leadership positions in the business.

Backed by Arcus Infrastructure Partners, Coolworld is an essential infrastructure partner to companies across the cold chain. Coolworld is currently active in six Northwest European countries, providing mission-critical, value-added rental solutions of temperature control assets from a network of six sites. Coolworld’s primary asset segments include modular cold storage, industrial chillers for process cooling and integrated climate control units. Coolworld provides its asset rental solutions to a wide range of core industrial end markets, including food, pharmaceutical, chemical, cold chain logistics and facility management customer segments.

Through the acquisition of CRS, Coolworld will establish a strong base of operations in two new countries, the UK and Ireland, and significantly deepen its value proposition in the modular cold storage segment. It will bring on board the innovative and solutions-led CRS team together with its in-house engineering and fabrication capabilities.

CRS currently owns a large fleet of modular cold storage units, serving an extensive customer base in the food and pharma sectors from three sites in the UK and Ireland. The business has significantly expanded its offering over recent years, building and leasing modular cold storage units of increasing sizes and more complex configurations, while adhering to growing regulatory and compliance requirements in its core end markets.

Commenting on the acquisition, Ruud van Mierlo, CEO of Coolworld said: “We are extremely pleased to join forces with the CRS team and build on their exceptional track record of growth and innovation in modular cold storage leasing. The Coolworld and CRS businesses are highly complementary on so many levels, and we are certain that together we will be able to provide a broader and even higher quality suite of rental solutions to our customers. We have been impressed with the growth trajectory and engineering know-how of CRS in the past and hold very high respect for John, Patrick and the wider team. Coolworld has been on a completely organic growth journey over the past few decades, and I could not think of better partners or a better company to undertake this transformational acquisition with. With highly supportive trends in the broader cold chain, we will be perfectly positioned to unlock an even stronger growth trajectory as one team.”

Commenting on the acquisition, John Tyrrell, Managing Director of The CRS Group said: “This announcement is a hugely exciting step in CRS’ continued growth journey and is a testament to all that the business has achieved since it was founded by our father over 30 years ago. Patrick and I would like to acknowledge the huge efforts made by everyone in the CRS Team. The Renatus team have been excellent partners along the way and have worked very closely with us over the last four years to implement and execute a highly ambitious business plan to become a market leader in the UK and Ireland modular cold storage leasing markets. Patrick and I as well as the wider CRS management team are really excited about the next phase of our expansion with Coolworld as we look to build on this great foundation, institutionalise our product engineering and operating model, and ultimately bring our solutions to customers across a wider geographic footprint. This is a great opportunity for all the team in CRS and our clients and the future international growth of the business.”

Commenting on the acquisition, Jordan Cott, Partner at Arcus Infrastructure Partners said: “CRS is a true specialist in the modular cold storage segment, with a strong culture and deep technical capabilities that will underpin growth for many years to come. We are delighted to partner with John and Patrick after having identified the business as an attractive cornerstone for an investment strategy in this sector several years ago. The acquisition fits perfectly with Coolworld’s strategy and is another excellent example of an Arcus portfolio company using strategic M&A to catalyse long-term value creation initiatives. We are hugely grateful to John and Patrick for trusting us as their partners to build on CRS’ family legacy and the strong foundations they have laid with Renatus over the past four years. We see a massive opportunity ahead for the combined Coolworld-CRS business to solidify its position as an international leader in temperature control asset rental solutions.”

Commenting on the acquisition, Brendan Traynor, Director of Renatus Capital Partners said: “We are thrilled to have had the opportunity to partner with John, Patrick and the wider CRS team over the last number of years as CRS has gone from strength-to-strength. The business experienced significant growth in both Ireland and the UK and it has been a privilege working with the exceptional CRS team. This transaction marks a significant milestone in the Group’s growth trajectory. We would like to thank John and Patrick as well as the wider team for their outstanding work and wish Coolworld and CRS every success in the future.”

About Coolworld

Coolworld is a prominent European specialist in industrial temperature control asset rental solutions. The company plays a pivotal role in maintaining cold chain integrity and ensuring operational and regulatory compliance in robust sectors such as food, pharmaceuticals, cold chain logistics and chemicals. In 2023, Coolworld was acquired by funds managed by Arcus Infrastructure Partners.

About The CRS Group

Founded in 1992 by Paul Tyrrell and currently led by his sons John Tyrrell (Managing Director) and Patrick Tyrrell (Sales & Technical Director), the Meath-based CRS Group specialises in upgrading and customizing cold stores into high-spec modular temperature-controlled storage units. These units form a critical component of the Cold Chain and are used predominantly by customers in the Food and Pharmaceutical sectors. In 2020, Renatus Capital Partners made a significant investment into CRS and partnered with John and Patrick to support their ambitious growth plans.

About Arcus Infrastructure Partners

Arcus Infrastructure Partners is an independent fund manager focused solely on long-term investments in European infrastructure. Arcus invests on behalf of institutional investors through discretionary funds and specialist co-investment vehicles and, through its subsidiaries, currently manages investments with an aggregate enterprise value of c. €23bn (as of 31 March 2024). Arcus targets mid-market, value-add infrastructure investments, with a particular focus on businesses in the digital, transport, logistics & industrials, and energy sectors.

About Renatus Capital Partners

Renatus is a leading boutique private equity firm investing into ambitious SMEs in the Irish and UK markets. Renatus was founded in 2014 by Mark Flood and Brendan Traynor and is headquartered in Dublin. The team are currently investing out of Renatus Capital Partners Fund III, which is backed by some of Ireland’s leading entrepreneurs as well as the Ireland Strategic Investment Fund and AIB.

Coolworld Advisers: Coolworld was advised by CIL (commercial), EY (financial, tax and IT), Matheson (legal), Arcadis (technical) and Aon (insurance)

CRS Advisers Corporate Finance – Renatus led by Brendan Traynor, Kyle Barry and Maram Mukhtar Financial – PwC led by Paul O’Connor, David Ridgeway and Ciaran Harrington Legal – LK Shields Solicitors led by Emmet Scully, Lisa McEllin and Megan Fennelly Tax – KPMG led by Kevin Corcoran and Marie O’Keefe

Management Team Advisers: Corporate Finance – Capnua led by Eamon Hayes and Conor Guerin Financials – BDO led by Rory O’Keeffe, Maurice Kennedy, Vaughan Coatzee Legal – Beauchamps led by Shaun O’Shea

- Logistics & Industrials

- Our News

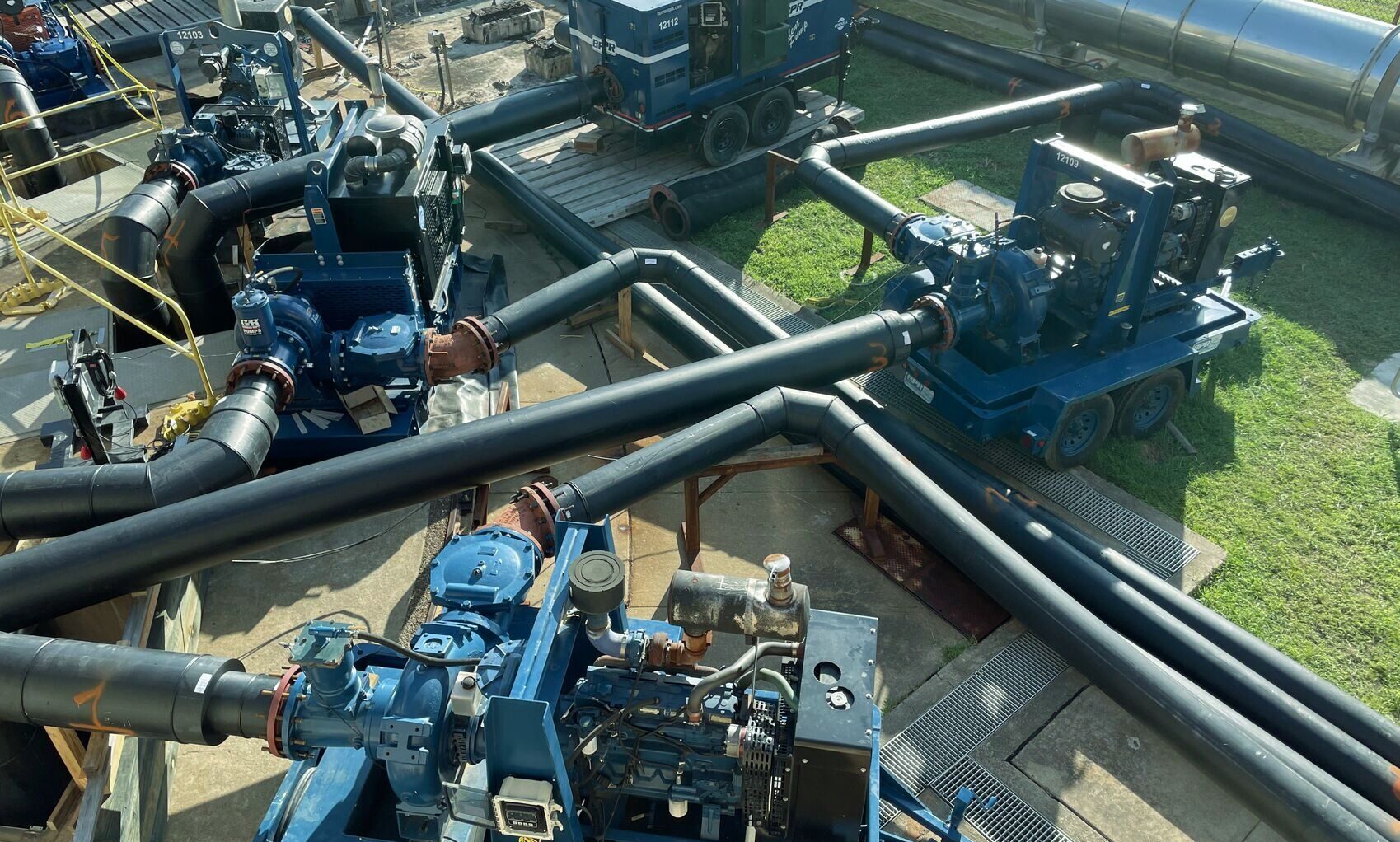

London, 17 July 2024 – Workdry International (“Workdry”), the parent company of engineered pump rental solutions and wastewater treatment asset rental providers Selwood, Siltbuster, and Vanderkamp, has announced a strategic expansion into the North American market through the acquisition of Holland Pump Company (“HPC”) a regional market-leading water handling and pump rental services provider in the United States.

The deal is backed by independent fund manager Arcus Infrastructure Partners (“Arcus”), through Arcus European Infrastructure Fund 3 (“AEIF3”) as Workdry’s majority shareholder. The acquisition will see Workdry immediately establish a market-leading presence in the East and Gulf Coast regions of the US, strengthening the combined group’s offering to the infrastructure, construction, municipal, and manufacturing sectors.

Workdry is acquiring the Florida-based business from a shareholder group led by XPV Water Partners. Since taking ownership in 2019, it has supported a series of strategic acquisitions to grow Holland Pump into one of the largest pure-play pump rental and service providers in the US, with over 1,000 pump assets, across 15 locations, and over 120 employees.

The company has a diversified and long-standing customer base, with its core end markets including municipal water infrastructure, core industrial segments, and broader transport infrastructure across its geographical footprint. HPC has a strong family and entrepreneurial heritage, with the founding family still active in the business, which aligns with Workdry’s history as a family business founded in the UK in 1946.

This move aligns with Workdry’s strategic expansion goals and follows its acquisition of the leading Dutch engineered pump rental solutions business, Vanderkamp Group, announced earlier this year. It establishes Workdry as a formidable player in engineered pump rental solutions on a global scale. Workdry plans to support the existing HPC management team, operating as the North American division of Workdry, in pursuing a high-growth strategy in its core markets, expanding through organic pump rental solutions growth, further M&A and leveraging its base of operations and Workdry’s expertise and asset solutions to introduce a modular wastewater treatment offering in the US market.

Holland Pump CEO, Tom Vossman, will continue to lead the US business, working closely alongside Workdry’s leadership team to integrate best practices and share expertise across the group. Tom, based in Texas, is an experienced leader in growing manufacturing, infrastructure and asset rental businesses who has delivered Holland Pump’s strategic plan over the past three years. He was appointed after XPV acquired Holland Pump from former owner and President, Win Blodgett.

Dan Lee, Group CEO of Workdry International, said: “Our acquisition of Holland Pump brings a well-established and respected business into our group, providing us with a strong entry point into North America which is the largest pump rental market in the world.

“I am delighted to welcome Tom and his team into the Workdry family. Our colleagues already know Holland Pump very well, having worked with them over many years to supply Selwood equipment to US customers. We know they share our vision and ambition and have a similarly strategic and acquisitive approach to growth, along with a passion for delivering outstanding solutions through exceptional people.

“Holland Pump brings huge value to the Workdry group, and we are looking forward to further adding to that value through continued investment, using our core business expertise, knowledge and capability to supercharge growth and success on both sides of the pond.”

Tom Vossman, CEO, Holland Pump, said: “We are excited to join the Workdry organisation. It’s clear we share a common vision for growth and expanding both our footprint and service offering looking into the future. I am very confident this will be a great combination of businesses to grow a global platform with the Workdry team.”

Jordan Cott, Partner at Arcus and Chair of Workdry, said: “Tom and his management team, together with the support of XPV and Win Blodgett, have built a hugely successful market leader in the US. We could not be more pleased that they have decided to partner with us to accelerate their growth trajectory through this next chapter.

“This acquisition continues Workdry’s impressive growth trajectory and opens new exciting opportunities in North America as Workdry continues to expand its mission-critical, rental-based solutions offering to support the maintenance, expansion, and delivery of sustainable water and wastewater infrastructure globally. We will be able to leverage our core rental proposition, including global market-leading engineering expertise and asset innovation, to significantly expand and strengthen HPC’s offering in the US and deepen its relationships with its valued long-standing customers.

“It fits perfectly within the Arcus value-add mid-market strategy of supporting market-leading businesses like Workdry on long-term value creation initiatives and builds on our successful track record of partnering with world-class entrepreneurs and family businesses.”

Sam Saintonge, Investment Partner with XPV Water Partners, said: “We are proud of the growth and success Holland Pump has had over the last several years. We are also thrilled to see the company and its team land with Workdry, an organisation with great support from Arcus that we have been very impressed with throughout the process.”

Selwood, Siltbuster and Vanderkamp currently deliver rental-based engineered solutions for water handling and wastewater treatment from 25 sites around the UK and Europe, with a fleet of over 6,000 pump assets and over 1,000 modular wastewater treatment assets.

Houlihan Lokey Inc. acted as financial advisor to Workdry. Catalyst Strategic Advisors LLC acted as exclusive financial adviser to Holland Pump.

For more information about Workdry see www.workdry.com

Ends

Notes to editors

WorkDry International delivers market-leading water handling and treatment solutions through its Selwood, Siltbuster and Vanderkamp businesses. www.workdry.com

Selwood has a head office and manufacturing facility in Hampshire, 21 pump rental solutions branches around the UK, and relationships with a global network of partners and distributors. www.selwood.co.uk

Siltbuster, based in Monmouth, Wales, operates across the UK as number one solutions provider for on-site water treatment, wastewater processing and the prevention of waterborne pollution. www.siltbuster.co.uk

Vanderkamp has a head office in Zwolle, The Netherlands, and delivers leading tailor-made temporary pumping solutions all over the world through state-of-the-art engineering.www.vdkamp.eu

Arcus Infrastructure Partners is an independent fund manager focused solely on long-term investments in European infrastructure. Arcus invests on behalf of institutional investors through discretionary funds and specialist co-investment vehicles and, through its subsidiaries, currently manages investments with an aggregate enterprise value of c. €23bn (as of 31 March 2024). Arcus targets mid-market, value-add infrastructure investments, with a particular focus on businesses in the digital, transport, logistics & industrials, and energy sectors. Further information on Arcus Infrastructure Partners can be found on www.arcusip.com

Holland Pump Company has been a leader in the manufacture, sale, distribution, rental and service of speciality pumps and dewatering solutions for over 40 years.

With a relentless focus on customer service and enabling its customers to complete their projects faster and with less hassle, Holland Pump has gained a reputation for its expertise in the United States.

From their headquarters in West Palm Beach, Holland Pump operates 15 branch operations across Florida, Louisiana, New York, Pennsylvania, Maryland, Texas and South Carolina.

For more information, visit www.hollandpump.com

XPV Water Partners is a team of experienced operators and investors who are committed to making a difference in water. The firm manages investment capital from some of the world’s top institutional investors, and partners with emerging water-related companies to help them rapidly expand and achieve their strategic goals.

XPV aims to generate strong, risk-adjusted returns for its investors by leveraging its trusted ecosystem, deep industry knowledge and its water centric company scaling platform.

XPV is committed to building partnerships that contribute to growing people, sustainable businesses, prosperous communities, and a better planet for everyone.

For more information, visit www.xpvwaterpartners.com