LONDON, United Kingdom (5 August 2020) – Arcus Infrastructure Partners is pleased to announce that it has been awarded full marks in the 2020 United Nations supported Principles for Responsible Investment (PRI) ESG assessment for the Strategy & Governance and Infrastructure modules.

Arcus was again awarded an “A+” for Strategy & Governance for the third consecutive year and improved to be awarded an “A+” for Infrastructure, from “A” in 2019. In addition to the A+ designation in both categories, Arcus achieved the maximum points score available, ahead of the peer median scores. Increasing our scores and ranking from the previous years and achieving full marks in both relevant categories demonstrates Arcus’ continuous commitment to improving ESG and sustainability management.

Neil Krawitz, Arcus Head of ESG, commented: “Arcus has been a signatory to the PRI since 2017. Arcus believes that investing responsibly protects the best interests of our investors and other stakeholders, and through identifying and managing any ESG issues early in the investment processes and actively managing and reporting them through the investment cycle, we generate long-term sustainable value for all stakeholders. We are proud of our award of full marks by the PRI, recognising our strong ESG performance.”

Media Contacts:

| Debbie Johnston

+44 7532 183811 |

Callum Spreng

T: +44 7803 970103 |

—-

About Arcus

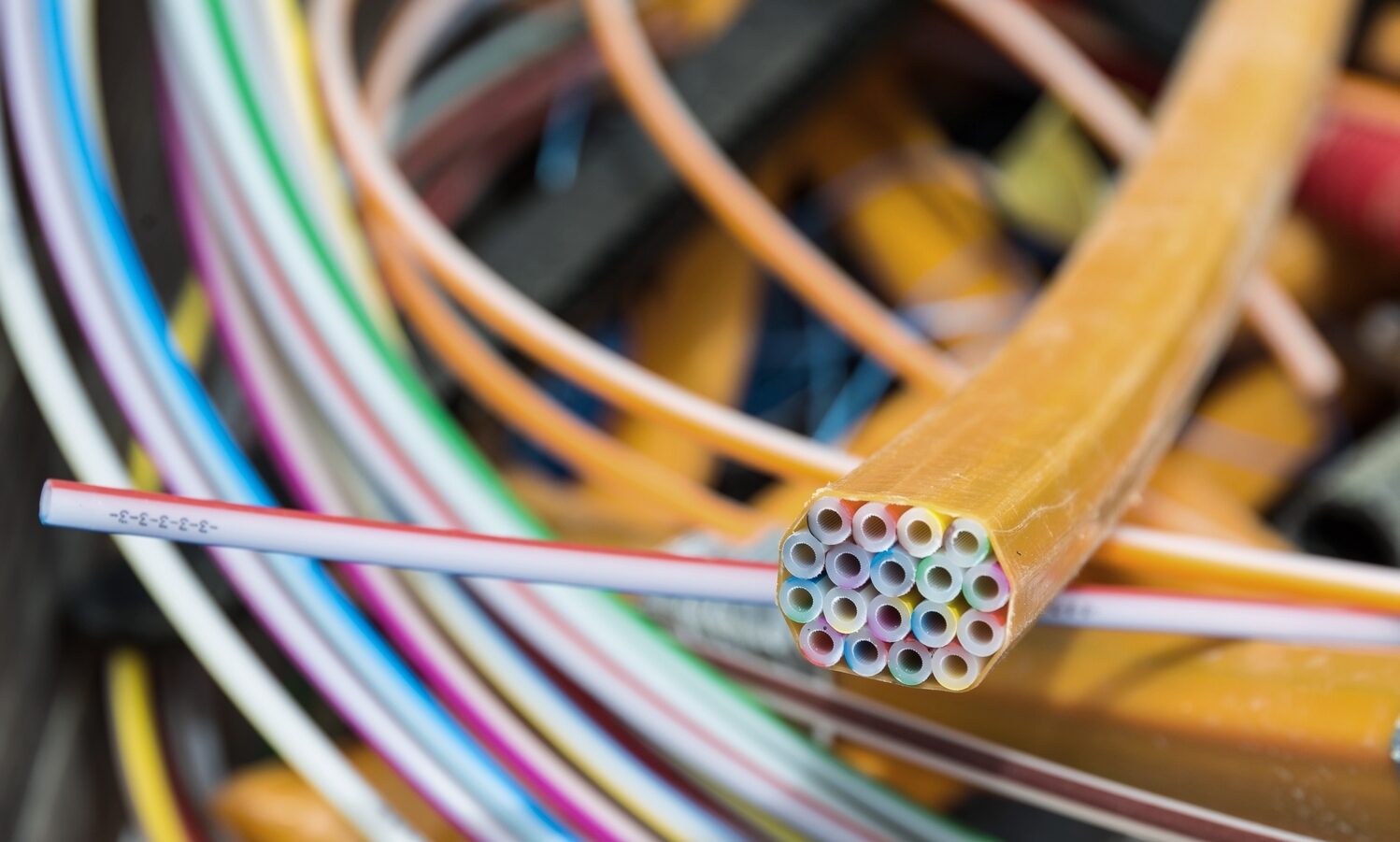

Arcus Infrastructure Partners is an independent fund manager focused solely on long-term investments in European infrastructure. Arcus invests on behalf of institutional investors through discretionary funds and special co-investment vehicles and, through its subsidiaries, currently manages investments with an aggregate enterprise value in excess of EUR 19bn (as of 31 March 2020). The Arcus investment track record includes: Forth Ports, Horizon Energy Infrastructure, Alpha Trains, E-Fiber and several other leading European infrastructure businesses. Arcus targets mid-market, value-add infrastructure investments, with a particular focus on businesses in the transportation, energy and telecommunications sectors.

For further information: www.arcusip.com

Linkedin/arcusinfrastructurepartners

—-

About the PRI

The PRI is the world’s leading initiative on responsible investment. The Principles for Responsible Investment are a voluntary set of investment principles for incorporating environmental, social and governance issues into investment practices. In implementing the principles, signatories contribute to developing a more sustainable global financial system. The principles have signatories including asset owners, investment managers and service providers from over 50 countries.

For further information: https://www.unpri.org/pri/about-the-pri