Insights.

Updates.

News.

Providing up-to-date coverage of Arcus and our portfolio companies

- Logistics & Industrials

- Our News

London, 29 January 2026 – HB RTS is pleased to announce the acquisition of PPS Group (“PPS”) in the UK. Following the earlier acquisitions of TPS in 2024 and TPS USA in 2025, this transaction marks another important step in HB RTS’s international growth strategy and its ambition to build a leading European platform for circular and reusable logistics solutions.

PPS is a well-established player in the UK market, with strong expertise in pooling, rental, washing services and the sale of returnable transport items through its Alison Handling division. The company has built a solid reputation for operational excellence and customer-focused service.

By welcoming PPS into the HB RTS network, the organisation strengthens its European footprint and further expands its service offering. The combination of regional expertise, additional capacity, and shared knowledge enhances HB RTS’s ability to support customers with reliable, scalable and sustainable logistics solutions across multiple markets.

Continuity and gradual integration

PPS will continue to operate from its strong regional positions in the UK and will gradually transition to the HB RTS name. The integration will be carried out carefully , with a strong focus on continuity and clear communication with customers, partners and employees.

Building a stronger European platform

Optimising logistics solutions across Europe is increasingly critical in a market where returnable transport items move seamlessly across borders. With this acquisition, HB RTS reinforces its ability to support international supply chains without geographical limitations. By offering consistent systems, processes and services across countries, HB RTS ensures continuity, efficiency and reliability for customers operating on a European scale. The group will continue to invest in circular logistics solutions that strengthen resilience, sustainability and long-term performance throughout the supply chain.

Eric Schrover, CEO of HB RTS: “This acquisition represents the next phase in our growth and development as a leading European load carrier pooling and logistics platform. PPS is a strong strategic fit, both in terms of services and culture. Together, we are building a stronger combined European business that allows us to support our customers with a wider offering and more consistently across borders.”

Joanne Lee, Managing Director PPS UK: “Joining HB RTS creates new opportunities for our customers and our teams. We look forward to combining our expertise while continuing to deliver the high level of service our customers expect.”

Jordan Cott, Partner at Arcus Infrastructure Partners said: “PPS is a strategically important acquisition for HB and a strong fit with its growing platform. The acquisition will strengthen HB’s position as a diversified load carrier pooling partner to the UK food sector, complementing the company’s existing operations in the UK and across Europe. We look forward to supporting Eric and the expanded HB team through this next exciting chapter of the company’s growth journey.”

About HB RTS

HB RTS is a leading provider of circular and reusable logistics solutions, specialising in pooling, rental, washing and management of returnable transport items across Europe and beyond.

About PPS

PPS is a UK-based logistics services provider specialising in pooling, rental and washing services, as well as the supply of returnable transport items through its Alison Handling division.

About Arcus

Arcus Infrastructure Partners is an independent fund manager focused solely on long-term investments in European infrastructure. Arcus invests on behalf of institutional investors through discretionary funds and currently manages €12.5bn of assets (as at 31 December 2025). Arcus targets mid-market, value-add infrastructure investments, with a particular focus on businesses in the digital, transport, logistics & industrials, and energy sectors. Further information on Arcus Infrastructure Partners can be found on www.arcusip.com.

- Digital

- Our News, Press

London, 7 January 2026 – Arcus Infrastructure Partners (“Arcus”) is delighted to announce the agreement to acquire Wifinity by Arcus European Infrastructure Fund 3 SCSp (“AEIF3” or the“ Fund”), with the management team retaining a small minority interest alongside the Fund. The transaction also marks an exit for UK private equity investor LDC following a successful four-year partnership.

Founded in 2007, Wifinity designs, builds, and manages mission-critical connectivity infrastructure network solutions for complex, multi-site, and multi-tenant environments. The Company generates resilient, predictable cash flows from serving clients across diverse markets including defence, leisure, specialist accommodation, corporate and public sector, and offshore, with specialised requirements and high barriers to entry underpinned by complex procurement processes, regulatory requirements and bespoke technical needs. These end-markets demand tailored connectivity solutions that traditional telecom operators lack the capability and service model to provide. The UK specialist managed Wi-Fi market is expanding rapidly and is forecast to grow at approximately 14% per annum between 2025 and 2030.

Christopher Ehrke, Partner and Head of Digital at Arcus, commented: “The acquisition of Wifinity represents an important step in broadening our exposure to the mid-market value-add digital infrastructure space. Wifinity’s proven expertise and scalable platform not only deliver seamless, secure connectivity in complex environments but also create significant opportunities for innovation and long-term growth across various verticals with promising prospects. We look forward to working closely with the management team as the Company enters its next phase of expansion.”

Costas Demetriou, CEO at Wifinity, commented: “This transaction marks an exciting new chapter in Wifinity’s evolution. Over the past eighteen years, we have built a market-leading platform focused on delivering highly resilient, bespoke connectivity solutions where connectivity is mission-critical and where deep technical expertise, operational resilience, and long-term partnerships truly matter. Arcus’ investment philosophy, experience in scaling essential digital infrastructure businesses and track record of supporting management teams combined with its long-term, value-add approach to investment, makes it an ideal partner for the next phase of our development. Together, we see a clear opportunity to accelerate organic growth across our core verticals, selectively expand into adjacent markets, and continue investing in our network, technology, and people, while maintaining the entrepreneurial culture that has underpinned Wifinity’s success to date.”

The acquisition of Wifinity represents the ninth investment in AEIF3 and the third in the Digital sector after the acquisitions of FixMap, the Fund’s Polish FTTH business , and Portus Data Centers, the Fund’s data centre platform in Germany and Luxembourg. The transaction is expected to complete in H1 2026, subject to relevant regulatory approvals.

Arcus was advised by Ashurst (Legal), Deloitte (Financial, Tax and Structuring), PMP (Commercial), LD Expertise (Technical), and Aon (Cybersecurity and Insurance).

About Arcus

Arcus Infrastructure Partners is an independent fund manager focused solely on long-term investments in European infrastructure. Arcus invests on behalf of institutional investors through discretionary funds and currently manages €12.5bn of assets (as at 5 December 2025). Arcus targets mid-market, value-add infrastructure investments, with a particular focus on businesses in the digital, transport, logistics & industrials, and energy sectors. Further information on Arcus Infrastructure Partners can be found on www.arcusip.com.

- Logistics & Industrials

- Our News, Press

London, 5 January 2026 – Arcus Infrastructure Partners (“Arcus”) is pleased to announce the acquisition of 100% of WCCTV Group Limited (“WCCTV” or the “Company”) by Arcus European Infrastructure Fund 4 SCSp (“AEIF4” or “the Fund”) alongside the WCCTV management team. The acquisition will mark the first investment for AEIF4, which successfully reached its €3bn hard cap in December 2025, following a seven-month fundraising period. The transaction also marks an exit for UK private equity investor LDC following a successful five-year partnership.

WCCTV is a full-service, specialised leasing provider of managed re-deployable video surveillance (“RVS”) assets for temporary security and monitoring solutions in the UK and the US. Established in 2001 and headquartered in Rochdale, UK, WCCTV offers an end-to-end specialist offering, comprising the leasing of fuel cell and solar-powered CCTV towers and trailers, along with a wrapper of value-added services such as advisory on site configuration, tech-enabled surveillance and monitoring connected to outsourced alarm receiving centres, ongoing asset maintenance, fuel provision, and, increasingly, data capture to support customer operations.

WCCTV operates from a strategically located network of 10 depot hubs in the UK and US, owning and leasing a well invested fleet comprising c. 1,655 RVS towers and c. 1,520 RVS trailers with a technical asset life for both RVS asset pools of c. 15-20 years. The Company serves a diversified, blue-chip customer base across infrastructure and utilities, government and law enforcement, large-scale commercial and industrial construction, retail, logistics, car parking and property management for a range of security and monitoring use cases. WCCTV’s solutions have a high degree of positive impact from an environmental, social and governance perspective, with solar-powered and low carbon towers and trailers across its fleet and a critical role to play in ensuring the security, safety and compliance of customer sites and assets.

WCCTV is one of the market leaders in the RVS solutions space, providing critical RVS asset leasing solutions which protect and monitor infrastructure and enterprise assets for a diversified range of resilient customer end markets. The Company is well positioned to support its customers through an ongoing multi-decade infrastructure and utilities asset renewal cycle as well as steady growth in broader industrial, commercial and government end market activity. WCCTV serves as an essential operating partner to its customers in addressing increasing security and monitoring requirements linked to rising asset values, sustained and elevated crime rates, worksite health and safety requirements, and tightening insurance, compliance and regulatory standards. As a pioneer in the development of RVS solutions, the Company continues to evolve its asset fleet and service proposition to ensure industry-leading operational standards and capabilities as RVS assets become the go-to solution to address a wide range of security and monitoring requirements.

Jordan Cott, Partner and Head of Logistics & Industrials at Arcus, commented: “WCCTV is an excellent fit with our AEIF4 investment strategy, providing mission-critical solutions to resilient and growing end markets, with a longstanding market leadership position underpinned by its value-added asset leasing business model and trusted customer relationships, and a significant value creation opportunity as the Company continues to innovate, improve and grow. WCCTV stood out as an ideal platform in the RVS solutions landscape given its unique combination of time-tested market leadership in the UK together with its strong foothold in the fast-growing US market. This is a perfect stage for Arcus to enter this market and support the business, as we will apply our significant experience investing in industrial asset leasing companies to optimise and accelerate WCCTV’s ambitious growth plan. We are delighted for this to mark our first investment for AEIF4 and look forward to partnering with David and the broader WCCTV management team through the next chapter.”

David Gilbertson, CEO of WCCTV, commented: “I am delighted to have a leading infrastructure investor like Arcus on board for the next phase of growth at WCCTV. Arcus recognises the strength of WCCTV, our people, our customer relationships, and the market-leading systems we have built over the past two decades. We have full alignment with Arcus on our long-term strategy and ambition, and we strongly believe that this partnership will give us the ideal platform to scale the business further, invest in our assets, technology and service offering, and ultimately accelerate growth across the UK and the US. This transaction marks an important milestone for WCCTV, and I am excited to work with Arcus as we build on our leading position and supercharge the next chapter of our growth journey.”

The transaction is expected to complete in Q1 2026, subject to relevant regulatory clearances.

Arcus was advised by Houlihan Lokey (M&A and Financing), Ashurst (Legal), Roland Berger (Commercial), Endava and WSP (Technical and Operations) Deloitte (Financial, Tax, Structuring), and Aon (Insurance).

About Arcus

Arcus Infrastructure Partners is an independent fund manager focused solely on long-term investments in European infrastructure. Arcus invests on behalf of institutional investors through discretionary funds and currently manages €12.5bn of assets (as at 5 December 2025). Arcus targets mid-market, value-add infrastructure investments, with a particular focus on businesses in the digital, transport, logistics & industrials, and energy sectors. Further information on Arcus Infrastructure Partners can be found on www.arcusip.com.

- Arcus

- Our News

London, 05 December 2025 – Arcus Infrastructure Partners (“Arcus”) is pleased to announce the successful closing of its fourth fund, Arcus European Infrastructure Fund 4 (“AEIF4” or the “Fund”). The Fund was significantly oversubscribed, surpassing its €2bn target and reaching its €3bn hard cap in just over seven months following launch. The speed at which the Fund was raised in an otherwise challenging fundraising environment, along with the significant investor demand exceeding the Fund’s hard cap, reflects Arcus’ strong investment track record and the depth and cohesion of its experienced team.

Arcus received strong support from its existing investors, achieving a re-up rate of more than 85%1, alongside participation from new institutions. This continued support from existing investors reflects strong confidence in the value-add investment approach of AEIF4, which will continue Arcus’ proven strategy of investing in high-quality mid-market infrastructure businesses across the digital, energy, logistics & industrial, and transportation sectors.

The Fund secured commitments from a highly diversified group of over 50 institutions, with approximately half of the capital raised in Europe and the remainder from North America, Asia, and the Middle East. Alongside strong support from pension funds, insurance companies, sovereign wealth funds, and asset managers, Arcus expanded its investor base by attracting significant commitments from endowments, family offices, and foundations, reflecting confidence in its strategy and long-term vision.

Ian Harding, Managing Partner, said: “We are extremely proud to have reached the hard cap for AEIF4 in such a short timeframe, particularly in a more difficult fundraising environment. The strong support from both new and existing investors reflects confidence in our strategy and our team’s ability to deliver compelling returns. We are deeply grateful for their continued partnership and look forward to investing the new fund in high-quality, mid-market infrastructure businesses with significant growth potential.”

Ronak Patel, Partner and Head of Capital Formation & Investor Relations, added: “This fundraise has attracted a truly global and diverse group of investors, strengthening the Arcus platform and broadening our reach. We greatly appreciate the confidence our investors have placed in us and for their support in enabling an efficient and successful fundraising process. We look forward to building on these partnerships in the years ahead.”

Established in 2009, Arcus has grown to a team of 78 professionals across four European offices and, with the successful close of AEIF4, now manages €12.5bn of assets2. The fundraising follows a highly successful 18 month period for Arcus during which it completed four new investments: Powering, an Italian power leasing business; Abyss AS, a Norwegian aquaculture service vessel provider; FixMap, a Polish fiber-to-the-home business; and eze.network, a German owner and operator of electric vehicle charging infrastructure. In addition, Arcus executed nine add-on acquisitions across its existing portfolio during this period and achieved three successful exits: the sale of Constellation Cold Logistics in October 2024 and the combined divestment of Horizon Energy Infrastructure and Smart Meter Assets in February 2025.

William Blair acted as fundraising placement agent for Arcus. Weil Gotshal & Manges acted as the legal and regulatory counsel. PwC acted as the tax adviser for the fundraising.

About Arcus

Arcus Infrastructure Partners is an independent fund manager focused solely on long-term investments in European infrastructure. Arcus invests on behalf of institutional investors through discretionary funds and currently manages €12.5bn of assets (as at 5 December 2025). Arcus targets mid-market, value-add infrastructure investments, with a particular focus on businesses in the digital, transport, logistics & industrials, and energy sectors. Further information on Arcus Infrastructure Partners can be found on www.arcusip.com.

- Arcus

- Our News

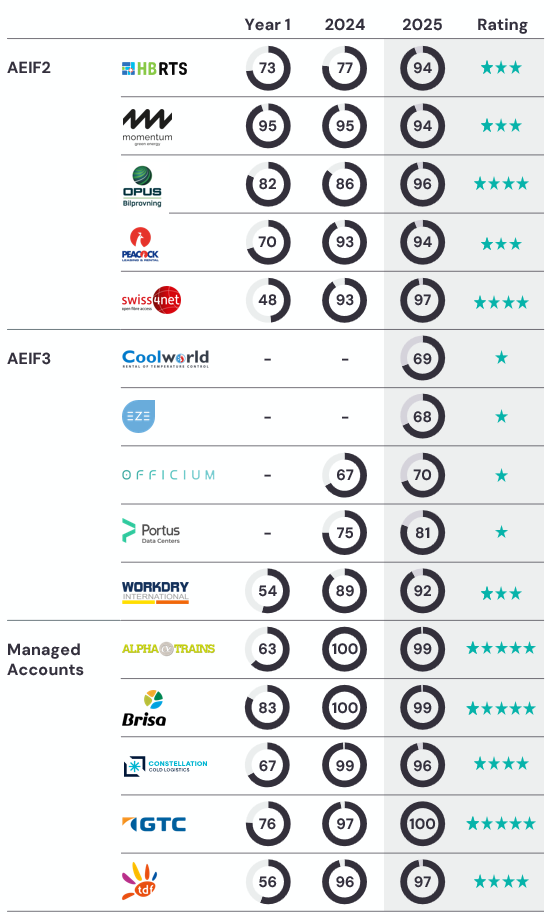

London, 04 November – Arcus Infrastructure Partners (“Arcus”) is proud to share its strong results in the 2025 GRESB Infrastructure Assessment.

Excellent scores were achieved at both a fund and asset level, demonstrating Arcus’ ongoing commitment to embedding ESG principles in its asset management. All Arcus funds scored maximum points in the Management component – which measures a fund’s ESG qualitative processes – scoring 30 points out of a possible 30, ranking first out of 135 infrastructure funds. This was achieved through a disciplined and systematic implementation of ESG initiatives at an Arcus level.

AEIF2

AEIF2 improved its score by three points to 96 out of a possible 100 in the 2025 GRESB Fund Assessment. This reflects strong ESG performance across the portfolio. Highlights included HB RTS improving its score from 77 in 2024 to 94 in 2025 – a 22% increase. Opus also performed strongly, rising from 86 to 96 points while Swiss4net increased from 93 to 97 points.

AEIF3

The AEIF3 GRESB fund score decreased slightly from 85 to 84 out of 100 in 2025, reflecting the first-time participation of two new AEIF3 assets, Coolworld and EZE, in the benchmarking process. As the AEIF3 portfolio continues to be built out, we expect to see some fluctuations in the AEIF3 fund score as the newer fund assets commence their participation in GRESB.

AEIF3’s third year participating in the GRESB Infrastructure Assessment demonstrated continued progress in ESG performance from returning participants. Each of Workdry, Portus, and Officium improved their scores, rising from 89 to 92, 75 to 81, and 67 to 70 respectively.

Coolworld and EZE participated for the first time, scoring 69 and 68 respectively – aligned with our expectations for first time participants. Arcus remains confident these assets will continue to improve in the coming years as we work closely with their management teams to implement and strengthen ESG initiatives across the portfolio.

GRESB Scores

Sector Leader Awards

Arcus A1 Investor vehicle LLP (GTC’s holding partnership) was awarded the fund Sector Leader status for both sector and region categories in the Infrastructure Fund assessment, ranking first out of the 99 funds completing a GRESB Fund Assessment.

GTC also received the asset level Sector Leader award, obtaining a score of 100 out of 100 points, ranking first in the transport category for the first time.

Arcus European Trains SCSp, (Alpha Trains’ holding partnership), also received the Sector Leader status for sector and region categories for the fourth year running.

Arcus’ ESG and external benchmarking approach

Given Arcus’ dedicated focus on infrastructure investments, sustainability remains a key area of focus and an important component of our investment strategy across all funds. We believe that our role as a controlling shareholder is inherently custodial, and that a thoughtful, proactive approach to ESG can deliver meaningful societal benefits.

External benchmarking initiatives such as GRESB play a critical role in this process, enabling Arcus to track year-on-year performance and uphold accountability for managing and delivering ESG initiatives.

This year marks the ninth consecutive year of Arcus’ participation in the GRESB Infrastructure Assessment, having joined at its inception in 2017. Arcus also contributes to industry best practice and the development of GRESB Standards through its membership of the GRESB Infrastructure Standards Committee, which it joined in October 2018, as well as Expert Resource Groups, which provide technical expertise, industry resources and guidance.

As ESG best practice continues to evolve, Arcus remains committed to maintaining the high standards we have set, while actively seeking opportunities for further improvement.

For any queries, please contact the Arcus IR team at investor.relations@arcusip.com.

About GRESB

GRESB is a mission-driven and industry-led organisation providing standardised and validated ESG data to financial markets. Established in 2009, GRESB has become the leading ESG benchmark for real estate and infrastructure investments across the world, used by c. 150 institutional and financial investors to inform decision-making. For more information, visit GRESB.com.

- Arcus

- Our News

In a recent episode of Infrastructure Investor’s Spotlight podcast, Neil Krawitz, Head of ESG and Asset Management at Arcus, shared insights on the importance of adopting a long-term perspective on sustainability. As climate change continues to drive more frequent and severe weather events, he emphasized that adaptation must become a central focus for infrastructure managers.

The conversation also explored the growing backlash against ESG and its implications for sustainability commitments. Despite these challenges, Arcus remains firmly committed to ESG, viewing it as an essential element of effective asset management and a cornerstone of a sustainable future.

🎧 Listen to the full discussion below.