London, 04 November – Arcus Infrastructure Partners (“Arcus”) is proud to share its strong results in the 2025 GRESB Infrastructure Assessment.

Excellent scores were achieved at both a fund and asset level, demonstrating Arcus’ ongoing commitment to embedding ESG principles in its asset management. All Arcus funds scored maximum points in the Management component – which measures a fund’s ESG qualitative processes – scoring 30 points out of a possible 30, ranking first out of 135 infrastructure funds. This was achieved through a disciplined and systematic implementation of ESG initiatives at an Arcus level.

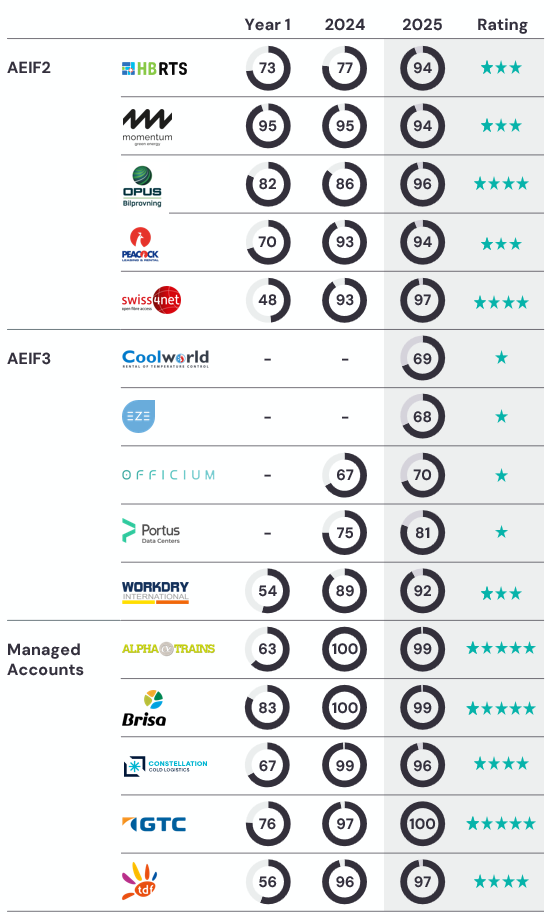

AEIF2

AEIF2 improved its score by three points to 96 out of a possible 100 in the 2025 GRESB Fund Assessment. This reflects strong ESG performance across the portfolio. Highlights included HB RTS improving its score from 77 in 2024 to 94 in 2025 – a 22% increase. Opus also performed strongly, rising from 86 to 96 points while Swiss4net increased from 93 to 97 points.

AEIF3

The AEIF3 GRESB fund score decreased slightly from 85 to 84 out of 100 in 2025, reflecting the first-time participation of two new AEIF3 assets, Coolworld and EZE, in the benchmarking process. As the AEIF3 portfolio continues to be built out, we expect to see some fluctuations in the AEIF3 fund score as the newer fund assets commence their participation in GRESB.

AEIF3’s third year participating in the GRESB Infrastructure Assessment demonstrated continued progress in ESG performance from returning participants. Each of Workdry, Portus, and Officium improved their scores, rising from 89 to 92, 75 to 81, and 67 to 70 respectively.

Coolworld and EZE participated for the first time, scoring 69 and 68 respectively – aligned with our expectations for first time participants. Arcus remains confident these assets will continue to improve in the coming years as we work closely with their management teams to implement and strengthen ESG initiatives across the portfolio.

GRESB Scores

Sector Leader Awards

Arcus A1 Investor vehicle LLP (GTC’s holding partnership) was awarded the fund Sector Leader status for both sector and region categories in the Infrastructure Fund assessment, ranking first out of the 99 funds completing a GRESB Fund Assessment.

GTC also received the asset level Sector Leader award, obtaining a score of 100 out of 100 points, ranking first in the transport category for the first time.

Arcus European Trains SCSp, (Alpha Trains’ holding partnership), also received the Sector Leader status for sector and region categories for the fourth year running.

Arcus’ ESG and external benchmarking approach

Given Arcus’ dedicated focus on infrastructure investments, sustainability remains a key area of focus and an important component of our investment strategy across all funds. We believe that our role as a controlling shareholder is inherently custodial, and that a thoughtful, proactive approach to ESG can deliver meaningful societal benefits.

External benchmarking initiatives such as GRESB play a critical role in this process, enabling Arcus to track year-on-year performance and uphold accountability for managing and delivering ESG initiatives.

This year marks the ninth consecutive year of Arcus’ participation in the GRESB Infrastructure Assessment, having joined at its inception in 2017. Arcus also contributes to industry best practice and the development of GRESB Standards through its membership of the GRESB Infrastructure Standards Committee, which it joined in October 2018, as well as Expert Resource Groups, which provide technical expertise, industry resources and guidance.

As ESG best practice continues to evolve, Arcus remains committed to maintaining the high standards we have set, while actively seeking opportunities for further improvement.

For any queries, please contact the Arcus IR team at investor.relations@arcusip.com.

About GRESB

GRESB is a mission-driven and industry-led organisation providing standardised and validated ESG data to financial markets. Established in 2009, GRESB has become the leading ESG benchmark for real estate and infrastructure investments across the world, used by c. 150 institutional and financial investors to inform decision-making. For more information, visit GRESB.com.