We identify.

We analyse.

We implement.

Realising unique investment opportunities and market-leading performance returns through a proven thesis-led approach.

We uncover unique investment opportunities

We seek out investment opportunities in the Transport, Energy, Digital and Logistics & Industrial sectors, and add hands-on asset management value over the lifetime of each investment.

We believe that a meticulous approach and a deep understanding are critical in order to think differently. We understand first, before applying creativity to the challenges that we face and the opportunities that we uncover.

Insight investing

Thorough analysis and extrapolation of long-term trends that are rapidly redefining the future.

Focused asset selection

Clear criteria through which investment opportunities are filtered so that they align with our capabilities.

Active asset management

Institutionalised, repeatable processes that are systematically applied to all our investment choices.

Insight investing

We anticipate and analyse long-term trends

We start with an exhaustive analysis of trends affecting our core European markets to shape our strategy and define investment sectors that will support tomorrow’s technology today.

Decarbonisation

Decarbonisation driving transportation and heating energy sources

of energy will come from wind and solar PV by 2050

Source:

2024 IEA World Energy Outlook

Changing demographics

Demographic shifts impacting consumption, logistics and transportation

of the population will be non-working dependants by 2050

Source:

Eurostat, Aug 2023

Data explosion

Ubiquitous connectivity driving disruption, efficiency and disintermediation

increase in data generation year on year

Source:

IDC Global DataSphere Forecast, 2025–2029

Focused asset selection

We identify unique investment opportunities

We draw on our entrenched network of offices and contacts to uncover uncommon investment opportunities and entry points in select sectors that sit within the Arcus nexus of expertise.

Sectors

Our investment strategyfocuses on four carefully chosen sectors

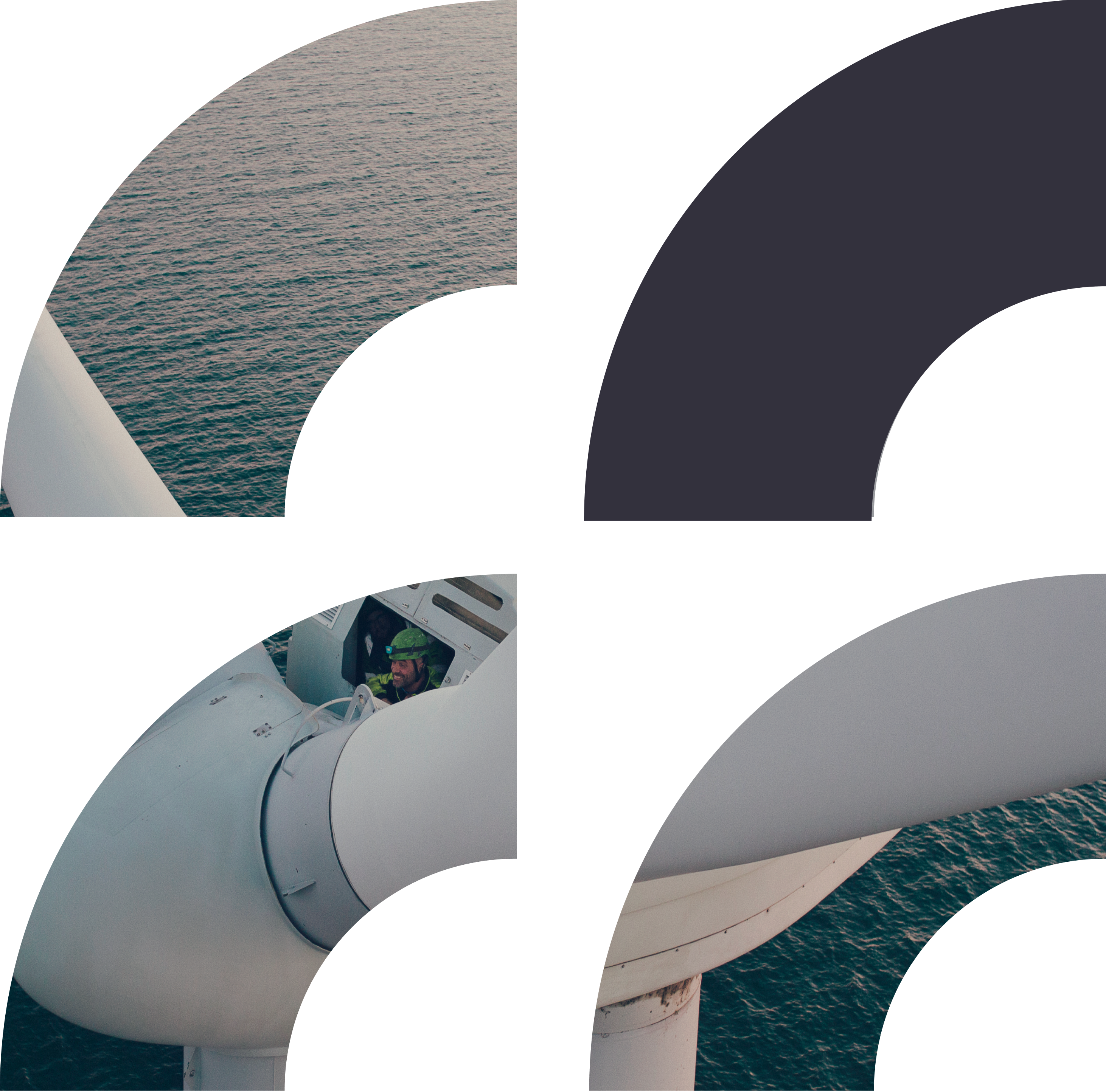

Digital

Energy

Transport

Logistics & Industrials

Size

We invest within a pre-defined equity range

€100 – €250m

Equity

Governance

We leverage significant influence and adopt a partnership approach

This is built on a strong reputation and clear alignment between partners, investors and other stakeholders. We always take a majority stake.

Approach

Our approach is structured into three core elements

- Thesis-led sourcing of deals

- Bi-lateral approach

- Stringent due diligence process

ESG

Our ESG process is thorough and transparent

- ESG initial screening and full due diligence

- ESG opportunity, risk analysis and mitigation plans

- Third party independent expert consultants

Sectors

Our investment strategyfocuses on four carefully chosen sectors

Digital

Energy

Transport

Logistics & Industrials

Size

We invest within a pre-defined equity range

€100 – €250m

Equity

Governance

We leverage significant influence and adopt a partnership approach

This is built on a strong reputation and clear alignment between partners, investors and other stakeholders. We always take a majority stake.

Approach

Our approach is structured into three core elements

- Thesis-led sourcing of deals

- Bi-lateral approach

- Stringent due diligence process

ESG

Our ESG process is thorough and transparent

- ESG initial screening and full due diligence

- ESG opportunity, risk analysis and mitigation plans

- Third party independent expert consultants

Shareholder leadership

Laying the foundations for our future initiatives

Angel Trains case study ▷

Management excellence

A team resourced and structured for success

Brisa case study ▷

Strategy & operations

Operational initiatives executed with tangible financial impact

Forth Ports case study ▷

Finance & reporting

Designing KPIs and reporting to enable the right decisions

Alpha Trains case study ▷

How we solve

active style of asset management

We find opportunities where others can’t, and help our portfolio companies achieve what might never have been possible.

This is enabled by our independent ownership structure, our meticulous origination approach, our entrenched presence in the European market, and the experience, continuity and focus of our team

Our commitment to sustainability

Our track record of strong performance goes hand in hand with our focus on the sustainability of the world around us.

We commit to prioritising both to deliver significant and enduring outcomes.

What we do

We partner with management teams to enable agile and adaptable businesses

We work closely with portfolio companies to create scaled and more resilient businesses that are positioned to meet the infrastructure needs of tomorrow.

Our 3 funds

AEIF3

Arcus European

Infrastructure Fund 3 SCSp

AEIF2

Arcus European

Infrastructure Fund 2 SCSp

AEIF1

Arcus European

Infrastructure Fund 1 L.P. (realised)

Our portfolio

“My plan would be the same but it would’ve taken me 10-15 years. They expedited my plan. Accelerated it and my businesses growth.”

Kim Madsen

Chairman, Momentum Green Energy