the value in

leading returns

About us

Arcus is an independent infrastructure fund manager with a focus on the European mid-market. We bring together deep expertise with a considered, rigorous and aligned approach that enables us to bridge the gaps between opportunities, exceptional returns and long term impact

€9.5 billion

Assets under management

13 active and 8 realised assets

2 active and 1 realised fund

Founding year

Partner-owned

Years of infrastructure experience

Sectors

We uncover opportunities where others won’t and think about investments in ways that others can’t.

We act as dedicated contributors to the success of our investments, providing the hands-on support required to achieve it.

Origination

Innovative origination: Constellation Cold Logistics

Constellation is a market-leading owner-operator of cold storage and logistics businesses that partner with large, diversified agri-food companies across Europe.

Asset management

Hands on asset management: Peacock Leasing & Rental

Peacock is a fast-growing, specialist lessor of over 27,000 sustainable intermodal tank containers to European and global operators, chemical companies, and food producers.

Performance

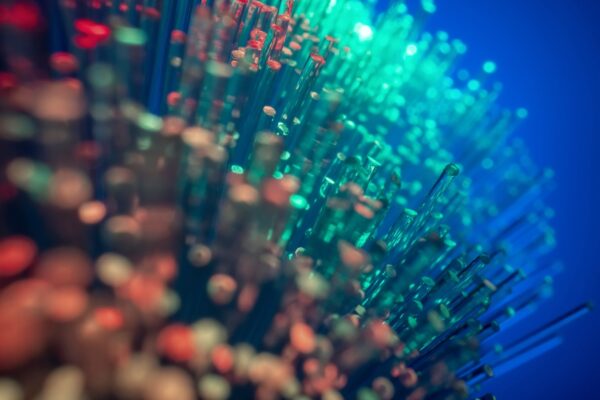

Results-driven performance: E-Fiber

E-Fiber is a growing fibreoptic network operator with over 336,000 fibre-to-home connections across 20 municipalities in smaller towns and semi-rural areas in the Netherlands.

Origination

Innovative origination: Constellation Cold Logistics

Constellation is a market-leading owner-operator of cold storage and logistics businesses that partner with large, diversified agri-food companies across Europe.

Asset management

Hands on asset management: Peacock Leasing & Rental

Peacock is a fast-growing, specialist lessor of over 27,000 sustainable intermodal tank containers to European and global operators, chemical companies, and food producers.

Performance

Results-driven performance: E-Fiber

E-Fiber is a growing fibreoptic network operator with over 336,000 fibre-to-home connections across 20 municipalities in smaller towns and semi-rural areas in the Netherlands.

The story of every one of our investments can be seen through our Asset Management Framework

We deploy our proven, repeatable framework to actively create value and drive results in four key areas.

Shareholder leadership

Laying the foundations for our future initiatives

Management excellence

A team resourced and structured for success

Strategy & operations

Operational initiatives executed with tangible financial impact

Finance & reporting

Designing KPIs and reporting to enable the right decisions

Our commitment to sustainability

Our track record of strong performance goes hand in hand with our focus on the sustainability of the environment around us.

We commit to prioritising both equally to deliver significant and enduring outcomes.

Affiliations

our funds

Arcus has to date managed three diversified funds.

2007

AEIF1

€2,167m raised

6 realised investments

2018

AEIF2

€1,217m raised

5 active investments, 4 realised

2022

AEIF3

€1,610m raised

8 investments, still investing

2025

AEIF4

€3bn raised

Investing

2013 – present

Managed accounts

€3,883m managed

4 investments

We focus our investments in four core sectors

Digital

Digital infrastructure and data consumption, available everywhere and always on, are fundamentally reshaping our world.

Transport

Mobility infrastructure is shifting with new demands and the development of data-driven, hyper-connected business models.

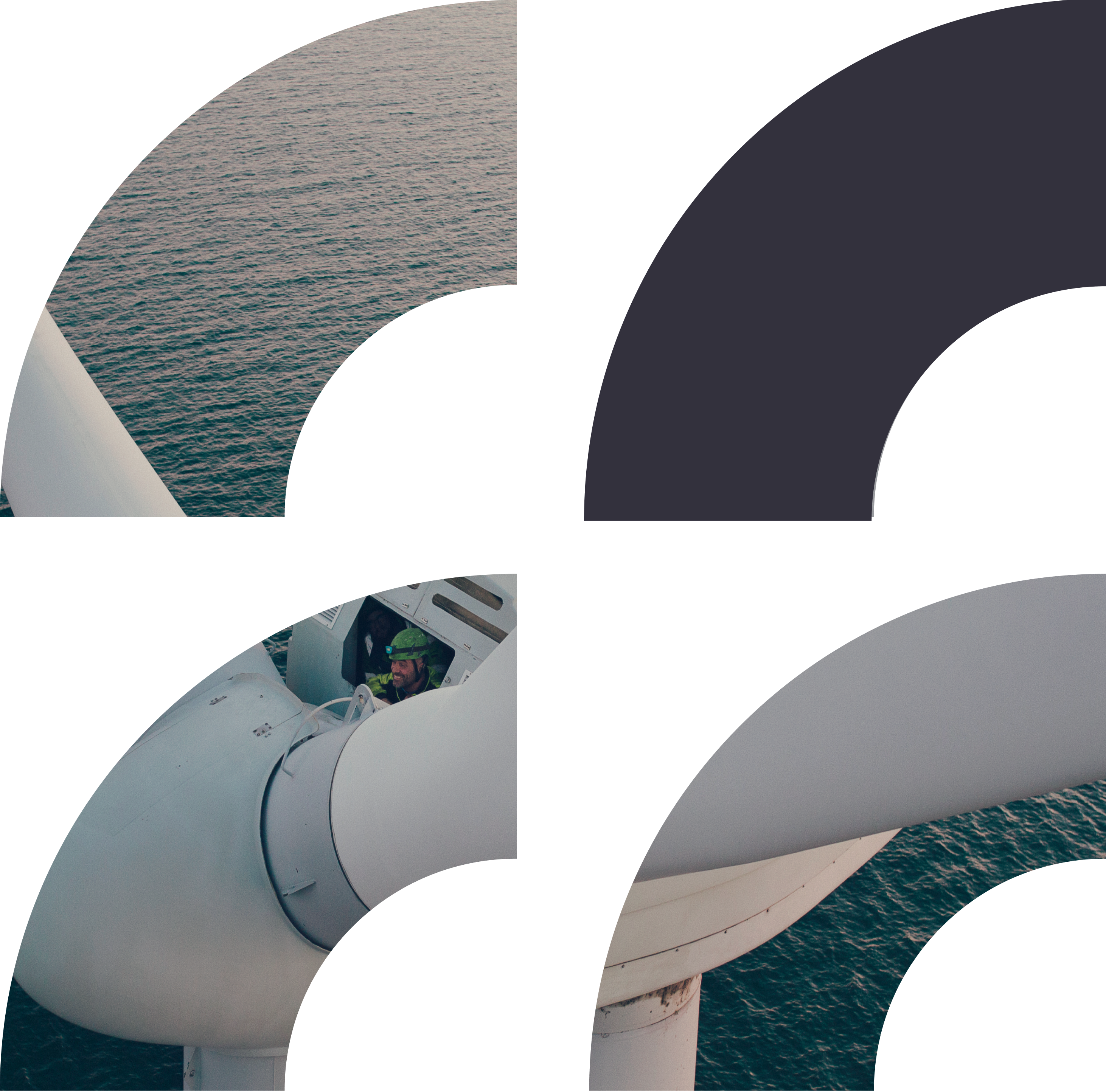

Energy

New network infrastructure, system flexibility and distributed generation is needed to effect the shift in carbon footprint.

Logistics & Industrials

Critical supply chains demand greater integration, agility and security to withstand increased environmental and social pressures.

Our portfolio

We’ve invested over €8.2bn of equity capital in 25 European infrastructure businesses.

“Arcus is defined by the continuity and collective experience of our team.”

Ian Harding,

Managing Partner

Our team is diverse in experience and perspective, but undoubtedly aligned with a focus on the future.

We believe that when a group of people with different perspectives unites behind a shared strategy, exceptional results can be delivered.

Nationalities

Investment & operations professionals

Our news

- Logistics & Industrials

- Our News

- Logistics & Industrials

- Our News, Press